KEY FACTS

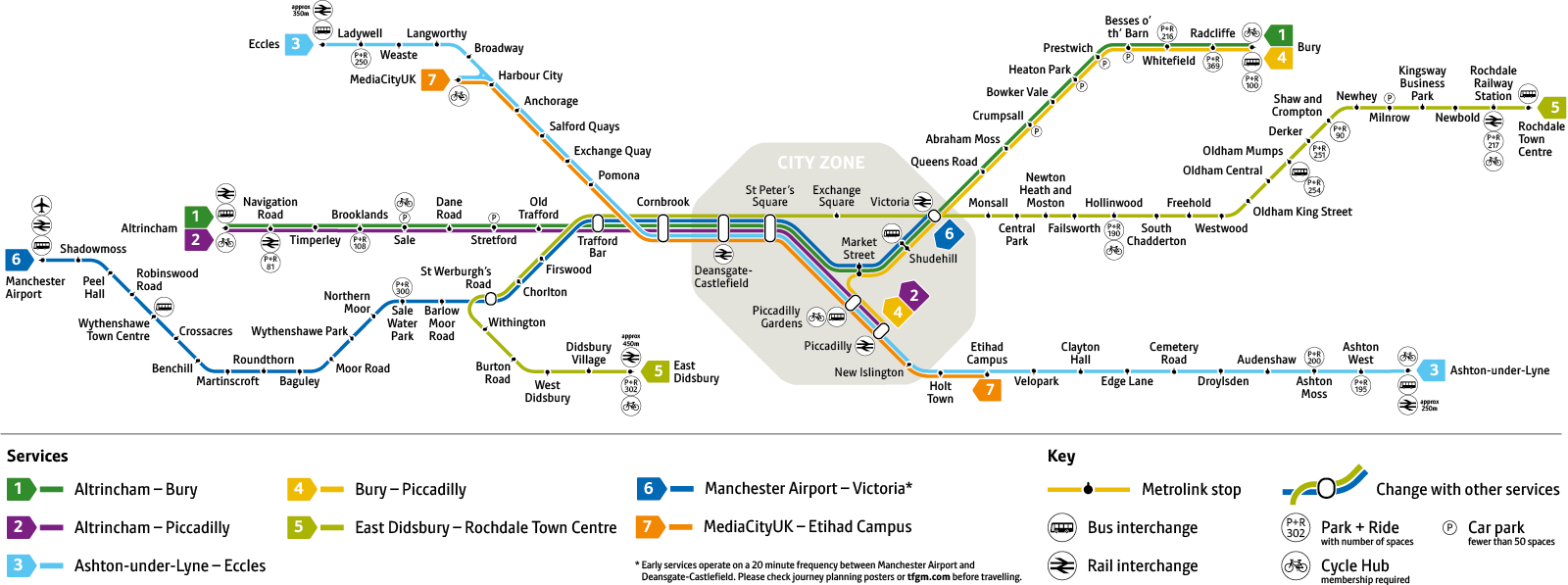

Transport: Transport for Greater Manchester (TfGM) has spent over £1.5 billion to expand and develop the city’s tram network (see map above) to deliver lines to Media City, South Manchester, East Manchester, Oldham and Rochdale, as well as a new depot facility at Trafford Bar. Rail links from Manchester Victoria and Manchester Piccadilly to the city’s suburbs and outlying towns are superb. For example, it takes only six minutes to get from Manchester Piccadilly to Stockport. Manchester Piccadilly will also benefit from a multi-million pound investment programme to accommodate HS2.

Economy: Manchester boasts the fastest growing economy outside of the capital and gross value added (GVA) growth projections of 45% between 2016 and 2036.

Employment: Between 2015 and 2020, the number of jobs opening up in Manchester is set to exceed opportunities in cities such as Tokyo, Berlin and Paris, with education and property both seeing rapid industry-growth.

Business: Business is booming in Manchester. New figures show that, as of 2018, there are 23,845 businesses in the city - a rise of 58% from 15,060 in 2014.

Manchester Airport: The flourishing airport is the gateway to Asia. It is the only northern airport with direct flights to Bejing and Hong Kong, while the £130m 'China Cluster' at the Airport’s Group's £800m business park provides a commercial base for Chinese businesses arriving in the UK and offers a wide range of high quality office premises. £1bn is also being invested in Terminal One to underline the airport’s world-class reputation.

Media City/Castlefields/Piccadilly Basin: The multi-million pound investment in these three key areas of Manchester city centre has created a thriving cultural, social and economic community. The development of MediacityUK, a 200-acre mixed-use property at Salford Quays, one of the first and largest urban regeneration projects in the United Kingdom following the closure of the dockyards in 1982, marked a large-scale decentralisation of media production from London. Principal tenants of this international hub for technology, innovation and creativity, include the BBC, ITV Granada and University of Salford.

Trafford Centre: Arguably the finest shopping centre in the north of England, Intu’s investment has paid dividends. Provides a first-class retail and leisure experience.